Good! Employee Share Scheme Discount From Deferral Schemes

NEW EMPLOYEE SHARE SCHEME RULES. If the discount is more than 15 tax on the discount is deferred until the shares.

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-02-59c7f3bdcea446f1abbba7d79f633ccc.jpg)

Employee Stock Option Definition Eso Calculation

Falling share prices can have the opposite effect.

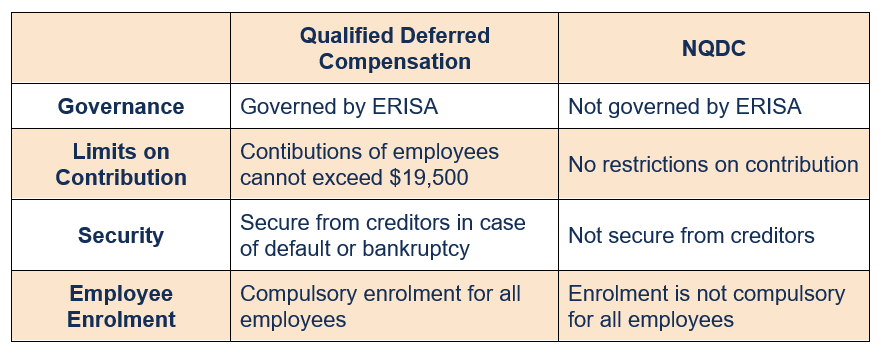

Employee share scheme discount from deferral schemes. Companies often use employee share schemes to remunerate and incentivise staff. Add up all the discount amounts you received from tax-deferred schemes where a deferred taxing point occurred during the current income year including amounts shown on your employee share scheme statements and. Tax advantages on employee share schemes including Share Incentive Plans Save As You Earn Company Share Option Plans and Enterprise Management Incentives.

This resets the cost base of the ESS interest to its market value at this time and resets the acquisition date which will be relevant to your eligibility for the 50 CGT discount. This means that the more profitable the company is the more likely it is that the employees will get a better return on their investment. There are many types of ESS but generally the type of scheme determines the tax treatment that applies.

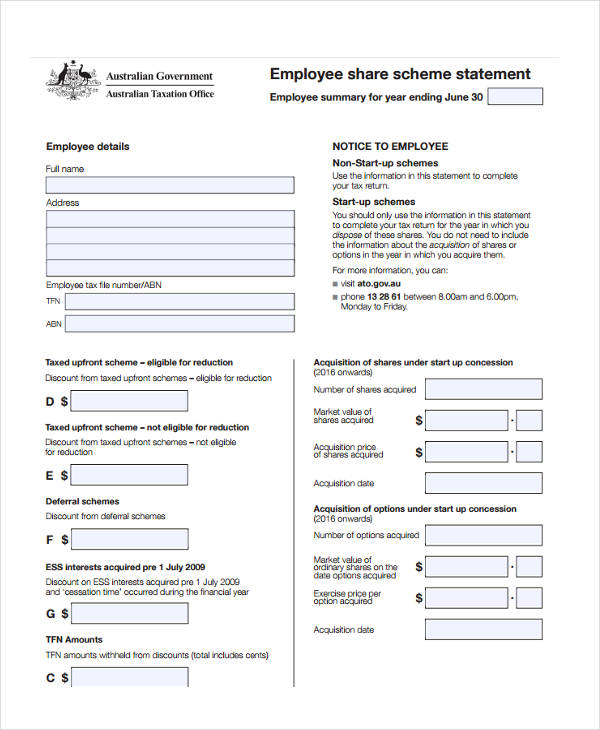

Your employer must provide you with an Employee share scheme statement which shows you the value of any discounts you have received on your ESS interests in 202021. Tax Deferral The taxing point can be deferred if the interests. When I complete my tax return in etax it results in me owing approx 25k to the ATO.

950 Discount from deferral schemes. Under current tax laws if ESS interests are granted to an employee at a discount and defined conditions are met then concessional tax treatment may apply. If you acquire ESS interests under a scheme that doesnt meet the conditions for a tax-deferred scheme or satisfy eligibility requirements for the 1000 reduction the total discount you receive will be assessable in the financial year you acquired the ESS interests.

If you hold them for longer than 30 days the amount you entered as discount from deferral schemes becomes your cost base assuming that you got the shares for no consideration and then you make a capital gain or loss when you sell them based on the sale price. The default position for employee share schemes is that a participating employee will have to pay tax on the discount in the income year the employee acquired the shares or options. You should seek independent taxation advice specific to your circumstances before entering into an employee share scheme.

In most cases employees will be eligible for special tax treatment known as tax concessions. Interests take the form of shares or rights options to acquire shares and are generally provided at a discount from market value. They can also result in more productive working relationships higher productivity and reduced staff turnover.

The opportunity to buy shares in the company in the future this is called a right or option. There are no significant changes to the proposals regarding exempt schemes. This taxing point can be deferred if all of the following conditions are met.

The rules of the scheme or a letter from your employer should advise you whether you have acquired ESS interests under a taxed-upfront or deferral scheme. An Employee Share Scheme is a scheme in which interests in an employer company or its subsidiaries are provided to employees or their associates in respect of the employees employment. Discount from taxed upfront schemes eligible for discount.

The tax concession for. User 773962 22 posts. With new rules taking effect from 1 July 2015 ESSs look set to become more attractive.

For an ESS interest for which tax is deferred the ESS interest and the share or right that it forms part of is taken to have been re-acquired immediately after the deferred taxing point. While the purpose of share schemes is to motivate employees to perform if the share prices fall despite their hard work then the share scheme could have the opposite effect and end up damaging the morale so its risky to only rely on share schemes as an incentive. This article discusses how you qualify to defer any tax otherwise payable on shares and options you acquire under an ESS and when that.

For the tax to be deferred your employee must not receive more than 5000 worth of shares or stapled securities during the year under salary-sacrifice arrangements from you their employer or your holding company. In a taxed-upfront scheme the employee is taxed on the discount that they receive in comparison to the market value at the time of acquisition. The share schemes give employees either a stake in the company or share options to invest in the company.

Significant changes were introduced on 1 July 2015 to the existing concessional deferral rules that apply to employee share schemes. Real risk of forfeiture tax-deferred scheme Some schemes include a risk that the employees ESS interests will be forfeited. 1000 discount on taxed-upfront schemes explained further below Deferred Taxing point discussed further below Taxed-Upfront Scheme.

From 29 March 2018 an employer can provide to their employees up to 5000 worth of shares to their employees per annum at a discount of up to 2000 per annum. To qualify for concessional tax treatment the following general conditions must be met. The ESS interests must be in the.

ESS Qualifying for deferral of the taxable discount. The benefit is not taxable to the employee. Shares in the company they work for at a discounted price.

A tax-deferred employee share scheme may be available up to 5000 per tax year through a salary sacrifice arrangement subject to certain conditions being met. This problem along with other complexities has meant that Employee Share Schemes ESSs have not been popular with small businesses. The primary changes to the deferral rules were to the deferral triggers which now.

Increase the maximum deferral period for shares and rights from 7. Label F - Discount from deferral schemes. Employee Share Schemes ESS align the interests of employers and employees by offering shares or the option to acquire shares to employees.

Employee share schemes ESS give employees a benefit such as. In certain situations a very small benefit of 1000 is available. ESSs allow companies to be more competitive in recruiting and retaining talented employees.

This is the first article in a three-part series explaining a number of key aspects of the Australian employee share scheme ESS tax rules.

Employee Share Schemes Atotaxrates Info

Profit Sharing Plan Definition Example Top 3 Types

Measuring And Reporting The Actuarial Obligations Of The Canada Pension Plan Billig 2018 International Social Security Review Wiley Online Library

Deferred Compensation Overview Types Benefits

Early Versus Deferred Standard Androgen Suppression Therapy For Advanced Hormone Sensitive Prostate Cancer Kunath F 2019 Cochrane Library

Employee Share Schemes Overview Of Tax Concessions And Considerations Cst Tax

Things To Keep In Mind When Participating In Subvention Schemes Schemes How To Plan He Is Able

Free 13 Employee Statement Forms In Pdf Ms Word

Ess Reporting Requirements For Employers Australian Taxation Office

Employee Share Schemes Removing Cessation Of Employment As A Taxing Point And Reducing Red Tape Wolters Kluwer

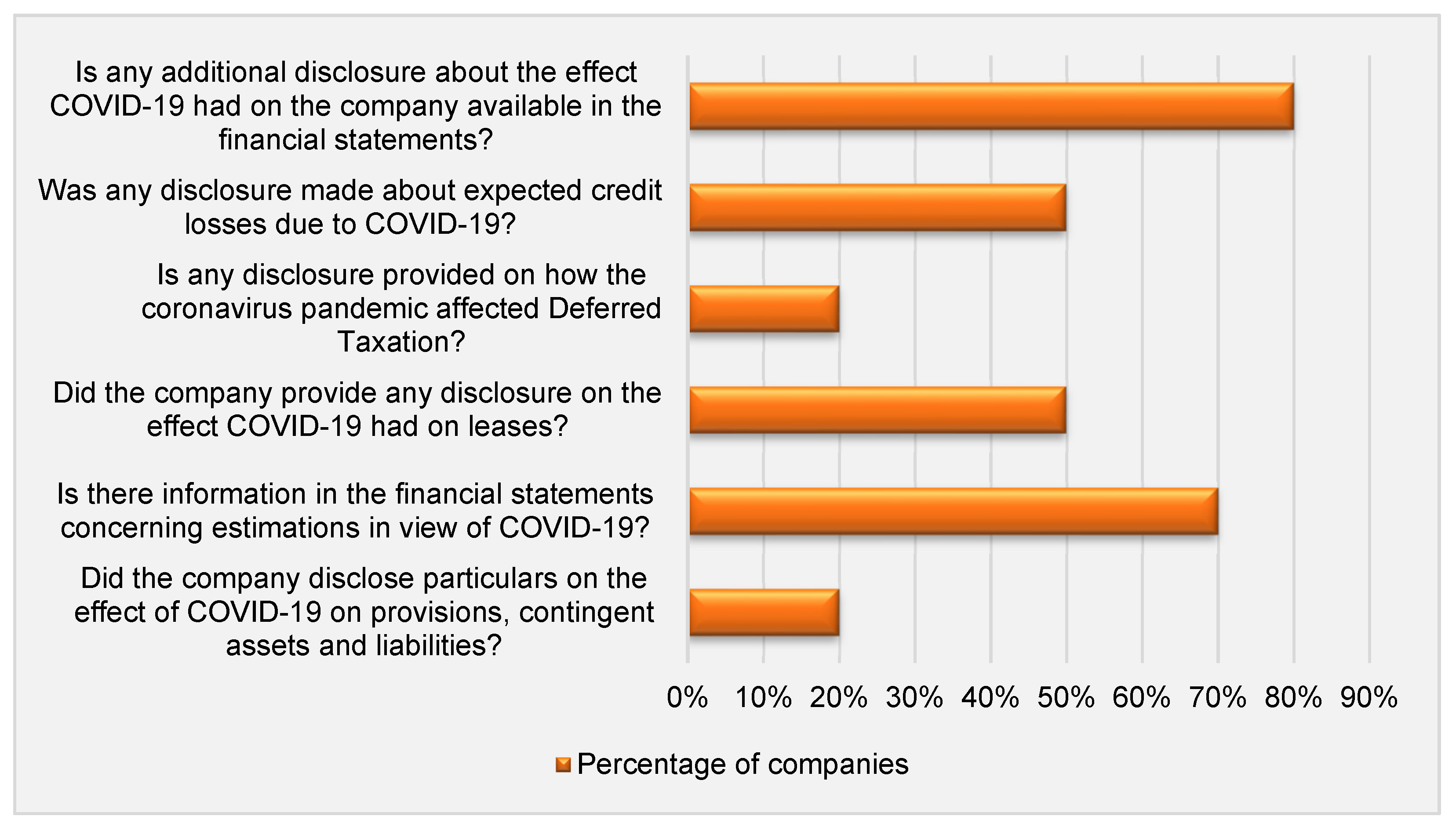

Sustainability Free Full Text Unpacking The Ifrs Implications Of Covid 19 For Travel And Leisure Companies Listed On The Jse Html

Book Summary Getting Things Done By David Allen Sam Thomas Davies Getting Things Done Book Summaries David Allen

Employee Share Schemes Overview Of Tax Concessions And Considerations Cst Tax

Things To Keep In Mind When Participating In Subvention Schemes Schemes How To Plan He Is Able